Is 2024 the Prime Year for Real Estate Investments?

The Current Market Status and Its 2024 Perspectives

Looking at the current trends, the real estate market is robust.

The pandemic influenced a shift in preferences, with suburban and rural markets witnessing a surge in interest.

As we head into 2024, sustainability, technology integration, and a focus on enhancing life quality through urban development are expected to be the leading forces shaping the domain.

Forecasting the Realty Sector in 2024

Technology and sustainable living are no longer buzzwords but guiding principles for the future. Homebuyers and tenants are seeking out properties that not only serve their immediate needs but also align with their long-term values. The forecast for 2024 is thus heavily tilted towards these aspects, predicting a surge in demand for environmentally conscious, smart, and community-oriented housing solutions.

The Evergreen Promise of Multifamily Properties

In the real estate constellation, multifamily properties have long shone as stars of investment.

The concept of shared living translates into multifaceted advantages, bridging the benefits for the investor with a community’s continuity.

Multifamily Investment for 2024 and Beyond

The multifamily segment is set to flourish in 2024. Not only is it a stable and predictable investment avenue, but it also mirrors the evolving needs of modern societies, where flexibility and community are vital. What’s more, the tax benefits and the diversification of risks make it an unbeatable package.

A New Dimension in Real Estate with Health and Fitness Amenities

Real estate’s metamorphosis into a comprehensive lifestyle product is in full swing. The integration of top-tier health and fitness amenities is redefining premium properties and transforming them into spaces for holistic living.

Beyond Leisure: The Economic Worth of Fitness in Realty

Constructing properties with exclusive wellness centers, yoga decks, and sports complexes isn’t just about keeping up with the competition; it’s also a strategic financial move. Properties catering to their inhabitants’ physical well-being command a premium and boast a higher retention rate, forging a direct link between fitness and financial fitness.

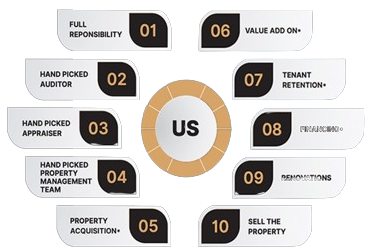

Strategically Positioning Your Real Estate Investments for Success

The real estate sector presents a labyrinth of opportunities, and successfully navigating it requires a strategy map.

Navigating the Market in 2024

Understanding the financial dynamics and the role of capital LLCs can pave the way for substantial profits in 2024. Entrepreneurs can leverage the sector’s dynamic nature and use technology to unlock new dimensions of success. Additionally, financial advisors play a crucial role in identifying tax planning opportunities and structuring real estate deals for optimized returns.

Seizing the 2024 Real Estate Opportunities

Real estate, with its tangibility and enduring appeal, continues to be a beacon of promise in an uncertain world. The prospects for 2024 are bright, and the time is ripe for those eager to venture into property investment.

Looking toward 2024 and beyond, real estate is a robust, multifaceted investment option. The onus is now on investors and stakeholders to seize this opportunity, tailoring their strategies to incorporate the year’s expected growth and aligning with the evolving needs and wants of the market.

Now is the time to envisage, invest, and influence the trajectory of your real estate portfolio. With thorough research, strategic planning, and a dash of foresight, success in the real estate market in 2024 is not just a possibility but a palpable promise.

It is time for those intrigued by the year’s potential to take action.

Whether by forging partnerships, gathering resources, or honing investment understanding, the real estate sectors of 2024 await.

The stage is set, the curtain is drawn, and the call for investment echoes through the halls of opportunity.

Will you be there to answer it?

Your Next Forward-Thinking Move Awaits

Be a part of something extraordinary.

Our commitment to integrating wellness within the residential experience not only redefines the living environment but also recreates the investment landscape.